MNCs sent tax notices over expat employees' allowances from foreign parent companies

Por um escritor misterioso

Last updated 16 outubro 2024

The demands, ranging from ₹1 crore to ₹150 crore, cover the period between FY18 and FY22 for payments by foreign parent companies to expats working in Indian subsidiaries of MNCs

Key Considerations for Expatriates Moving to India for Work

How do Multinationals extract their income from subsidiaries in different countries to the Headquarters or to different a subsidiary? - Quora

Legal Entity Setup Overseas: Is It Really What You're Looking For?

Tips for Handling International Employee Relocation

What Foreign Businesses Should Know Before Hiring Employees in Thailand, by 9cv9 HR and Career Blog, Top Rated by Readers, Nov, 2023

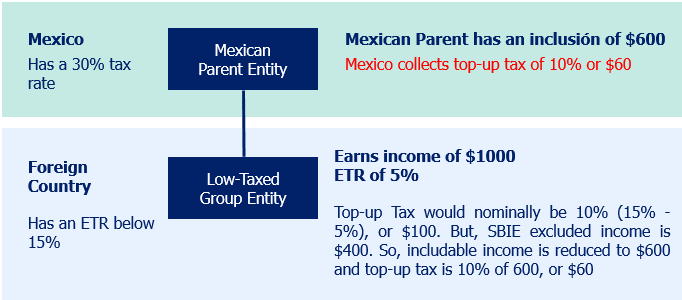

2023 Mexican Tax Considerations for Mexican and Foreign Taxpayers, Insights

Expatriate - Wikipedia

Decomposing Multinational Corporations' Declining Effective Tax Rates

The importance of shadow payroll for global businesses

Who Is and Is Not an Expatriate

Recomendado para você

-

Wars Calculator Med School16 outubro 2024

-

15 Steps To Prepare A Legal Interior Design Contract16 outubro 2024

15 Steps To Prepare A Legal Interior Design Contract16 outubro 2024 -

How many years of income does an average home cost?16 outubro 2024

How many years of income does an average home cost?16 outubro 2024 -

Калькулятор умений для игры Contract wars: русский, английский16 outubro 2024

Калькулятор умений для игры Contract wars: русский, английский16 outubro 2024 -

What Is Earnest Money? - SmartAsset16 outubro 2024

What Is Earnest Money? - SmartAsset16 outubro 2024 -

Currency Exchange Services: Four Benefits For Exporters and Importers16 outubro 2024

Currency Exchange Services: Four Benefits For Exporters and Importers16 outubro 2024 -

How to Find the Right Contract Manufacturer (CM)16 outubro 2024

How to Find the Right Contract Manufacturer (CM)16 outubro 2024 -

CCK's Zachary Stolz Testifies at Hearing Before House Subcommittee on Veterans' Affairs16 outubro 2024

CCK's Zachary Stolz Testifies at Hearing Before House Subcommittee on Veterans' Affairs16 outubro 2024 -

10+ Film Production Contract Templates - PDF, Word16 outubro 2024

10+ Film Production Contract Templates - PDF, Word16 outubro 2024 -

Pitch Trim Runaway - AOPA16 outubro 2024

Pitch Trim Runaway - AOPA16 outubro 2024

você pode gostar

-

Pokemon Brilliant Diamond and Shining Pearl - New Features - SAMURAI GAMERS16 outubro 2024

Pokemon Brilliant Diamond and Shining Pearl - New Features - SAMURAI GAMERS16 outubro 2024 -

Cursed Messages Copy And Paste16 outubro 2024

-

Issue with google-chrome headless issue with chrome-php · Issue #429 · chrome-php/chrome · GitHub16 outubro 2024

-

Luigi's Mansion Arcade - PrimeTime Amusements16 outubro 2024

Luigi's Mansion Arcade - PrimeTime Amusements16 outubro 2024 -

GRAN PIECE ONLINE GRÁTIS ROBLOX16 outubro 2024

GRAN PIECE ONLINE GRÁTIS ROBLOX16 outubro 2024 -

Found Roblox on Google Earth !16 outubro 2024

Found Roblox on Google Earth !16 outubro 2024 -

Meciuri de Legendă: Barcelona - Steaua (Cupa Campionilor Europeni, Spania), O NOAPTE DE MAI16 outubro 2024

Meciuri de Legendă: Barcelona - Steaua (Cupa Campionilor Europeni, Spania), O NOAPTE DE MAI16 outubro 2024 -

GECKO MORIA KAGE KAGE no MI16 outubro 2024

GECKO MORIA KAGE KAGE no MI16 outubro 2024 -

Perú no Forno com Laranja16 outubro 2024

Perú no Forno com Laranja16 outubro 2024 -

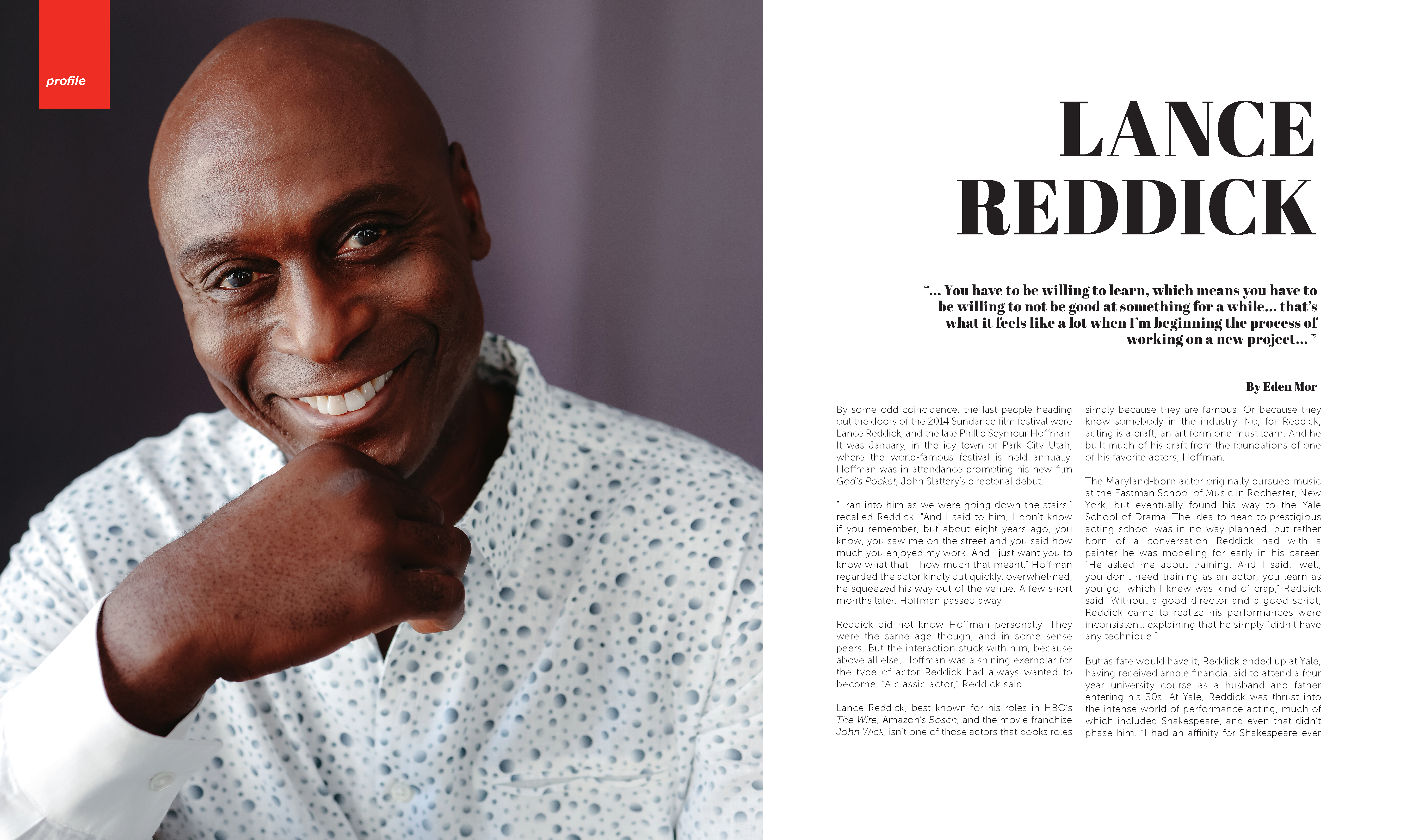

Lance Reddick – Moves Fashion & Lifestyle Online16 outubro 2024

Lance Reddick – Moves Fashion & Lifestyle Online16 outubro 2024