Itemize - Home

Por um escritor misterioso

Last updated 22 setembro 2024

Itemize automates B2B financial document processing, enhances risk assessment, and helps approve transactions via streamlined information flows and improved business intelligence.

Is New Flooring Tax Deductible?

Are you 'Kondo'ing' your home? There's a hidden tax benefit to tidying up – Press Enterprise

How Itemized Deductions Work

Common Itemized Deductions

Simplified Home Office Deduction: When Does It Benefit Taxpayers?

Are Your Home Improvements Tax-Deductible?

Get a Tax Credit for Buying a House

Homeowners & New Limit on SALT Deductions - SKJ&T

Solved) - A self-employed taxpayer who itemized deductions owns a home, of (1 Answer)

Can I include interest payments as an itemized deduction? - Universal CPA Review

Are Home Improvements Tax-Deductible? The Rules Explained, with Examples

Article

13 Tax Breaks for Homeowners and Home Buyers

Tax-reform changes will alter home-owning rationale for some

Is Buying A Home A Good Investment?

Recomendado para você

-

QuickBooks Invoice Forms with Perforated Payment Voucher22 setembro 2024

QuickBooks Invoice Forms with Perforated Payment Voucher22 setembro 2024 -

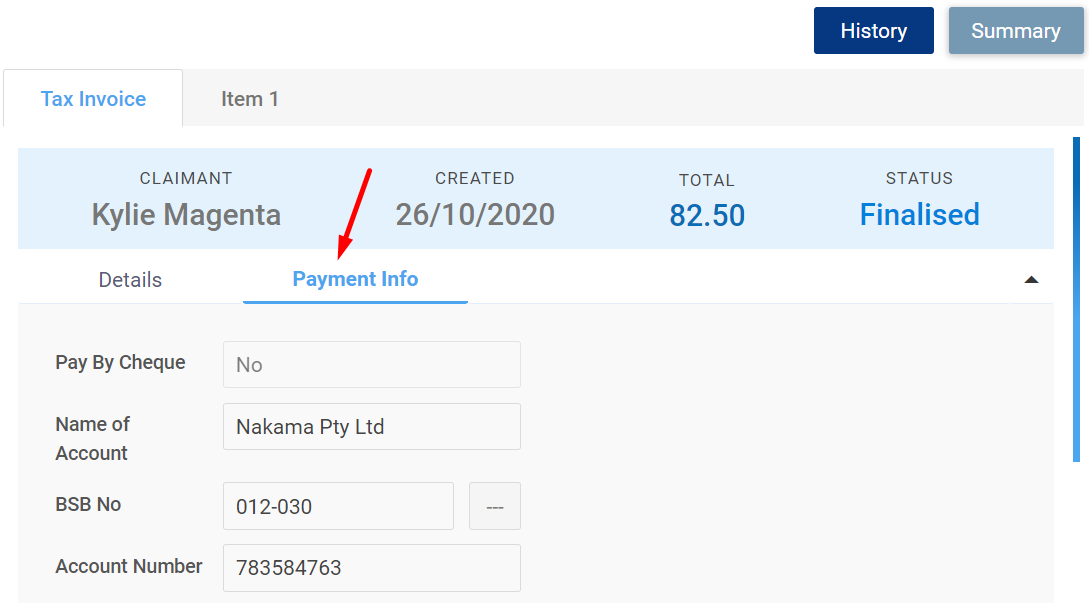

What is 3-way matching in AP and why do you need to implement it?22 setembro 2024

What is 3-way matching in AP and why do you need to implement it?22 setembro 2024 -

Disbursement Checks - InsureLinq22 setembro 2024

Disbursement Checks - InsureLinq22 setembro 2024 -

![Blank Invoice Template - Step by Step Overview [Free Download]](https://www.wallstreetmojo.com/wp-content/uploads/2019/templates/Blank%20Invoice%20Template%20(main).jpg) Blank Invoice Template - Step by Step Overview [Free Download]22 setembro 2024

Blank Invoice Template - Step by Step Overview [Free Download]22 setembro 2024 -

Free Invoice Template - Download and Send Invoices Easily - Wise22 setembro 2024

Free Invoice Template - Download and Send Invoices Easily - Wise22 setembro 2024 -

Free Purchase Order (PO) Template22 setembro 2024

Free Purchase Order (PO) Template22 setembro 2024 -

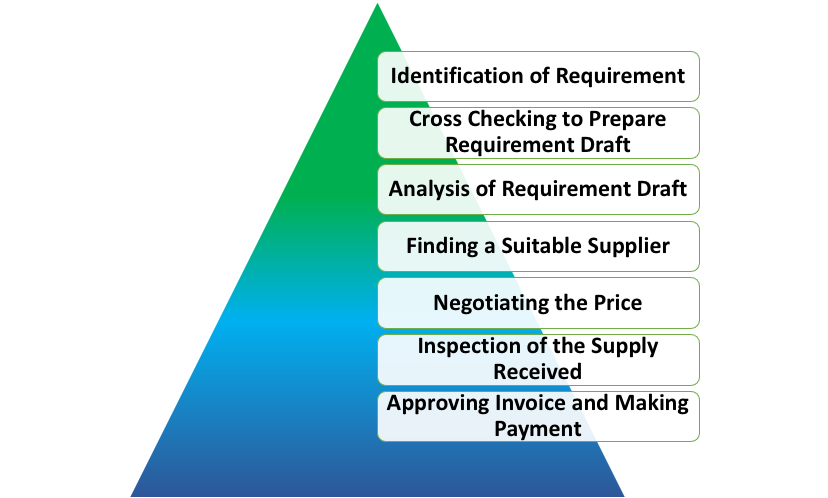

What Does a Procurement Specialist Do?22 setembro 2024

What Does a Procurement Specialist Do?22 setembro 2024 -

ABA File22 setembro 2024

ABA File22 setembro 2024 -

PayPal Invoice template (FREE - Updated 2023) - Bonsai22 setembro 2024

PayPal Invoice template (FREE - Updated 2023) - Bonsai22 setembro 2024 -

Complete Guide to Commercial Invoices22 setembro 2024

Complete Guide to Commercial Invoices22 setembro 2024

você pode gostar

-

Shigeru Miyamoto and Chris Meledandri Fan Casting22 setembro 2024

Shigeru Miyamoto and Chris Meledandri Fan Casting22 setembro 2024 -

Jeff is out! Maze Runner Character Elimination Game: Round 9. Vote for your LEAST favourite character ( you have 24 hours to vote ) : r/MazeRunner22 setembro 2024

Jeff is out! Maze Runner Character Elimination Game: Round 9. Vote for your LEAST favourite character ( you have 24 hours to vote ) : r/MazeRunner22 setembro 2024 -

Ajuntament de Ciutadella de Menorca22 setembro 2024

Ajuntament de Ciutadella de Menorca22 setembro 2024 -

Know Your Puffins Smithsonian Ocean22 setembro 2024

Know Your Puffins Smithsonian Ocean22 setembro 2024 -

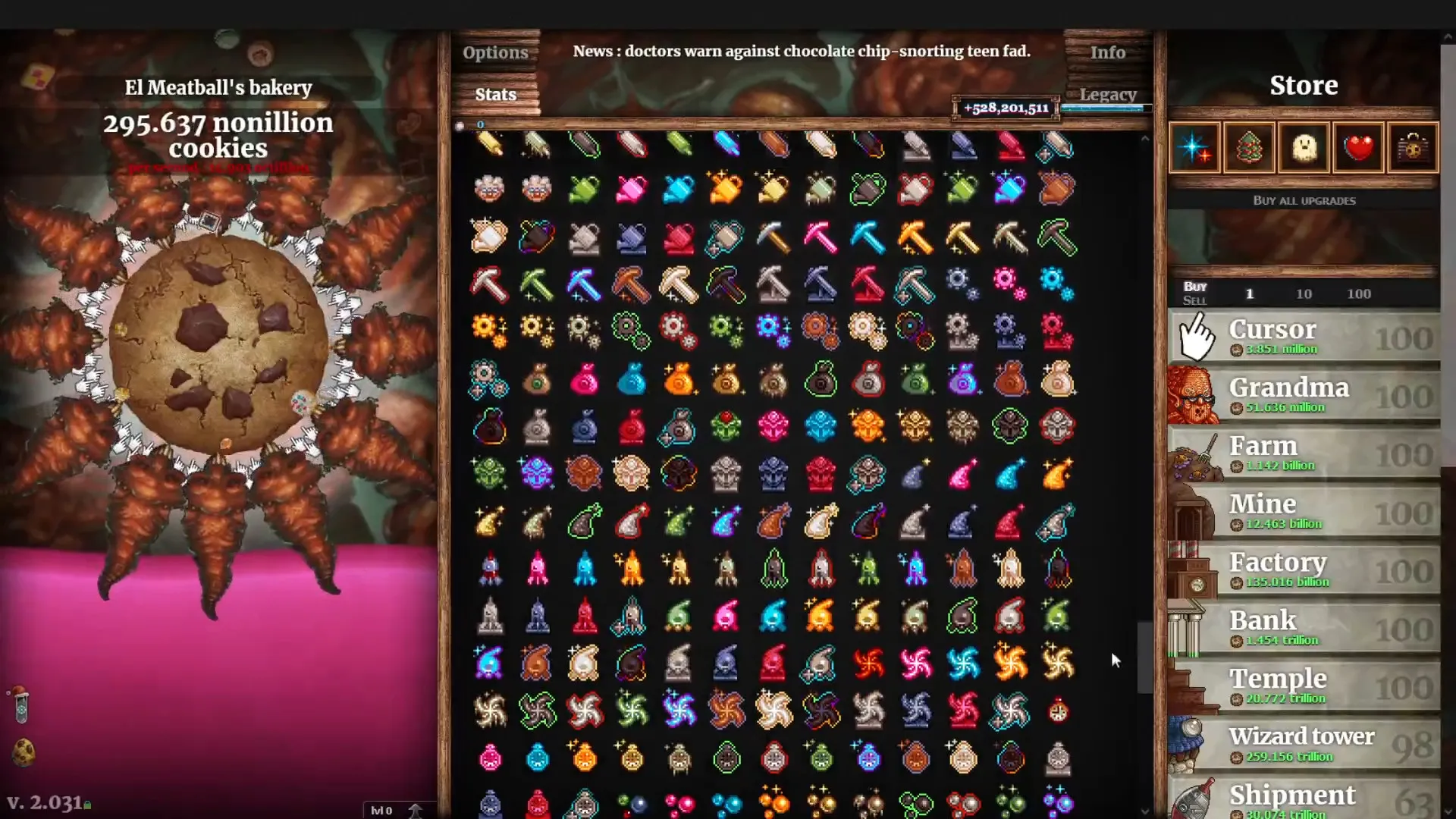

How to Get Infinite Cookies in Cookie Clicker - Guide - Touch, Tap22 setembro 2024

How to Get Infinite Cookies in Cookie Clicker - Guide - Touch, Tap22 setembro 2024 -

Domestic Girlfriend 20 eBook by Kei Sasuga - Rakuten Kobo22 setembro 2024

Domestic Girlfriend 20 eBook by Kei Sasuga - Rakuten Kobo22 setembro 2024 -

Prince of Persia: Revelations - IGN22 setembro 2024

Prince of Persia: Revelations - IGN22 setembro 2024 -

Lords of the Fallen Game Review - 40+ Hours of Gameplay Insights — Eightify22 setembro 2024

Lords of the Fallen Game Review - 40+ Hours of Gameplay Insights — Eightify22 setembro 2024 -

Lawn Fawn Intro: Batty for You - Lawn Fawn22 setembro 2024

Lawn Fawn Intro: Batty for You - Lawn Fawn22 setembro 2024 -

DEATH BATTLE! Idea #35: Kratos Vs War by CLANNADAT on DeviantArt22 setembro 2024

DEATH BATTLE! Idea #35: Kratos Vs War by CLANNADAT on DeviantArt22 setembro 2024